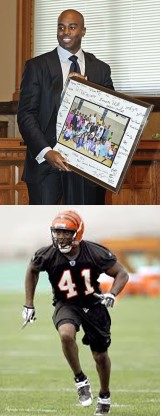

Investing in real estate is a key component of building and generating wealth. Former NFL star, Chinedum Ndukwe built a successful career investing in real estate. Armed with a double degree in Business Management and Psychology from the University of Notre Dame, Nduke formed his company Kingsley + Company, after retiring from the NFL in 2012.

The Chicago Defender spoke with Chinedum Ndukwe about building wealth through real estate, what current property owners can do to build equity in their properties and what potential real estate investors should look for when purchasing any property.

Chicago Defender: How did you successfully transition from a career in the NFL to becoming a successful real estate investor, business owner, and entrepreneur?

Chinedum Ndukwe: The biggest thing that I realized was as hard as it was for me to make it in the NFL and be successful on the field, it was equally as hard to be successful in business. It took the same amount of work and time. It is important to be laser-focused on what you want to achieve. That’s how I made it to the NFL and that’s why we’ve been able to build our company up to what it is today. I understood that as an athlete, the NFL was not long-term. So, I knew I was going to need another career. I began with the end in mind. While I was playing, I knew it was never too soon to start planning for that second chapter.

Chicago Defender: What motivated your interest in Real Estate?

Chicago Defender: What motivated your interest in Real Estate?

Chinedum Ndukwe: I was exposed to real estate at an early age. Like many classic immigrant stories, my parents came to America from Nigeria in the mid-70s. They worked multiple jobs and paid their way through school My mom is a registered nurse, and my dad is a mechanical engineer. I grew up watching them work their day jobs, but they always had a side hustle. That was real estate. They bought single-family homes, renovated them, and leased them out.

It seemed like a natural transition for me coming out of the NFL. As soon as I started making money after my second year of playing football, I started to invest in real estate. In the offseason, I’d buy and renovate properties. That’s when I really got into it.

Chicago Defender: With the economy being the way it is right now, is this a suitable time to invest in real estate?

Chinedum Ndukwe: I get that question all the time, from, former players and everyday individuals that are either looking to buy a home or looking for investment property and I always say that whatever you are doing in life, you have to become a student of the game. Once you start investing in yourself and understanding the intricacies of real estate, you understand that there are opportunities in good markets, and there are opportunities in down markets. There will always be opportunities but it’s about aligning yourself with the right network of people that are truly finding those deals that can make or break your success.

I encourage people to network. Talk to people, talk to real estate agents, if you’re not a current real estate agent. If you’re interested in real estate, it is a great way to learn how real estate gets sold and purchased. Even with the economy and inflation, there are good opportunities out there and there’s no better way to protect your cash than investing in real estate during inflationary times.

Chicago Defender: You have a double degree in Business and Psychology but were there other things you did to educate yourself on the real estate industry?

Chinedum Ndukwe: I sought out mentors in real estate. Initially, I was buying single-family homes, but I always had the motivation to expand and do more. I sought out people within the industry to learn from. I not only reached out, but I cultivated those relationships. At times, some of those relationships became so close that we became partners on projects. Having mentors allowed me to learn firsthand. It wasn’t about just paying someone to do the job but investing in properties alongside them.

It took years to develop the knowledge, develop relationships, and mentors within affordable housing, to actually be able to put a shovel in the ground on our own affordable housing projects. The mentorship was invaluable as I learned the business.

Chicago Defender: Can you offer some tips to some of our readers who may be interested in investing in real estate or for existing property owners on how to pick properties or how to determine what types of real estate they may want to invest in?

Chinedum Ndukwe: Whenever I’m looking at opportunities I will go to areas where there is a lot of investment happening, but I’ll also look at areas that are a few blocks over. I’m asking where are the trends, and where are the jobs that populate these areas.

I encourage real estate investors to look at it two ways. One, you could be the pioneer and look at investing in areas that are not developed. It’s risky but I’ve experienced higher gains in areas that have not yet been developed.

Second, look for properties in communities that are already developed. You may find houses or apartments that may provide an opportunity where the developments already happened. But there might be houses or apartments available for sale. There are deals to be made and sometimes there may be opportunities to slide in, negotiate, and use your people skills, to be able to work out a resolution on some of those opportunities.

Lastly, there is nothing wrong with paying a premium for very well-located real estate. There is value in having Class A properties on Class A locations. I encourage people that prefer less risk to look at investing in a premium property in an excellent location because over time, even if you overpay a little bit, that’ll eventually catch up with appreciation.

Chicago Defender: You mentioned you’ve invested in affordable housing. How do you navigate your investments in underserved communities that desperately need affordable housing with the gentrification of many of our neighborhoods?

Chinedum Ndukwe: I take our affordable housing efforts very seriously because I know a large population of minorities, specifically African Americans rely on affordable housing and there’s just not enough of it. It is a balancing act in improving areas, but also being mindful of the legacies and the families that have been in certain houses for a very long time. We try to find properties that need to be repurposed, and renovated, to improve the area around them.

Chicago Defender: What advice would you give homeowners or property owners to build equity in their real estate purchases and investments?

Chinedum Ndukwe: People often undervalue themselves and their assets. You have to be mindful of the land you invest in and the areas around it. Having a valuation is important. Investing in an appraisal is key to understanding what your current value is. After that, it’s about investing and doing small things like either building out that carriage house on a building, potentially upgrading the bathrooms, or upgrading your kitchens. Those are key value drivers that increase the equity in your property.