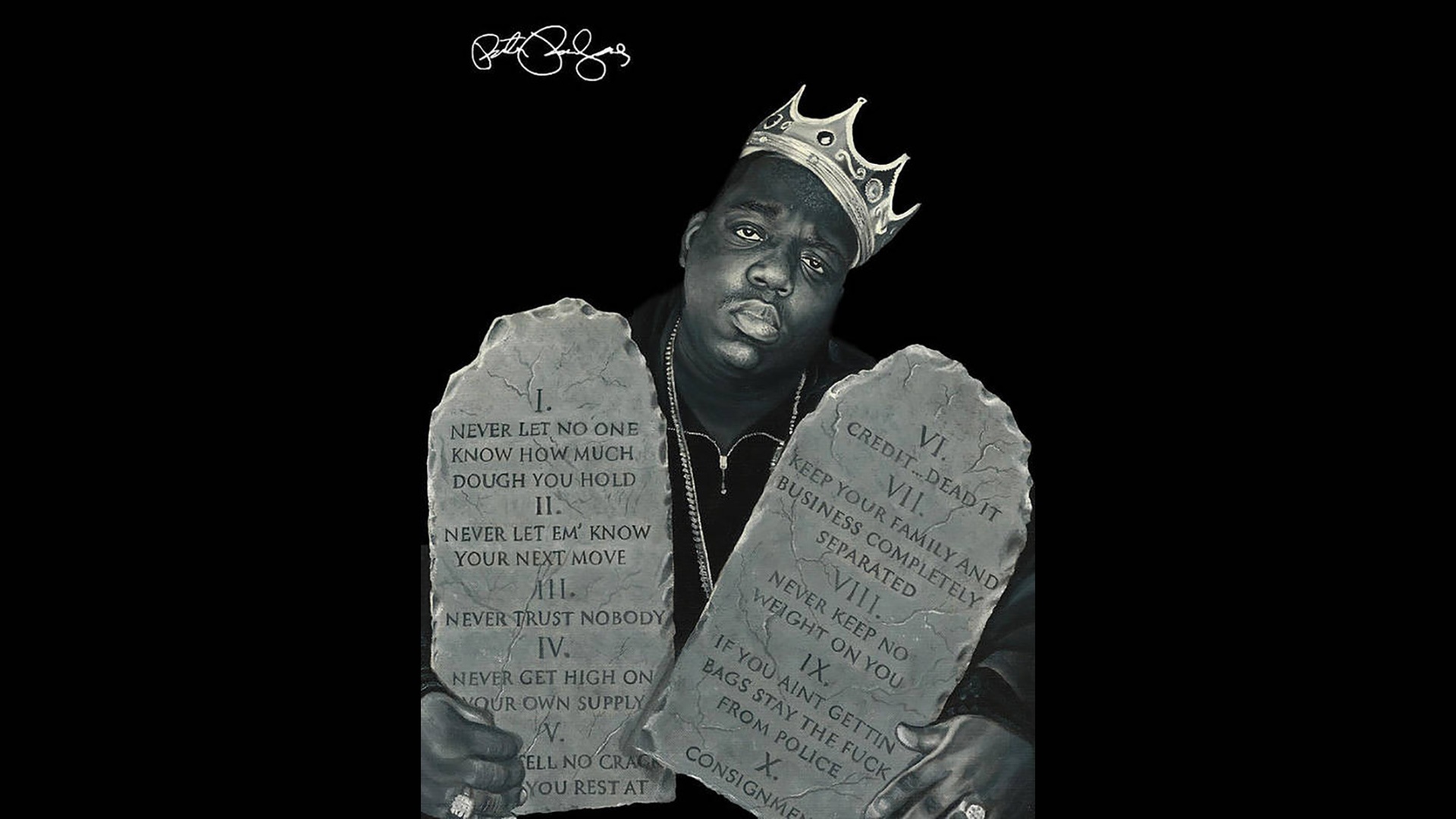

I was having a nostalgic moment driving through my childhood neighborhood bumping to some Notorious B.I.G. The song “10 crack commandments” started playing. When I listen to music, most times I’m grooving to the beat. I’m not necessarily listening to the lyrics. But on this day, I listened to the words. In this song, Biggie details his step by step manual on how to successfully navigate through the drug world. He gives 10 commandments on how you can get your game on track. Not your wig pushed back. In other words, Biggie is describing how you can win with money in the drug game without being victim to the streets—be it robbed, jailed, or killed.

I’m in the business of teaching people how to win with money. We often feel robbed by low wages, high prices, high interest rates, and limited opportunities. We feel imprisoned to our lifestyle, our responsibilities, escalating expenses and mounting debt. Our dreams are often killed as we navigate through life trying to figure out how to create forward momentum and get ahead financially. When you can’t see and experience forward progress with your money, it’s akin to getting your wig pushed back. How can we survive and thrive as we navigate through life with all the ups and downs?

If Biggie, who’s often quoted saying “Mo Money, Mo problems,” can provide insight on how to win in a violent world of drugs, surely we can find wisdom in his commandments to apply and win with money. Let’s dive into his step by step manual. His lyrics are explicit and revolves around drugs. So, I’ll take creative liberty to make his words applicable here. I’ll also add some commentary.

Rule # 1: Never let anyone know how much money you have because money brings jealously— People don’t openly discuss money. But you have several people who are flashy and braggadocious. This can create unwanted attention and make you a mark for robbery. Also be smart about things you post on social media. Letting people know you’re away on vacation can make your home a target.

Rule #2: Never let them know your next move—They say bosses move in silence. If they’re not helping you achieve your next goal, there’s no need for them to know anything about what you’re doing until it’s done. There are too many dream-killers out there including close friends and family. Be mindful and very selective of who you include in your circle of influence.

Rule #3: Never trust anybody—Do you want to see how people really are? Wait until money is involved. When it comes to money, everybody is a suspect. Money has a way of exposing the worst in people. When dealing with money, allow people to earn your trust over time by transacting small amounts first. Don’t lend money—especially to family and friends. If you have the money, can do without it, and it’s within reason—give it to the person whom you deem has a sincere need.

Rule #4: Never get high on your own success—It’s OK to be confident and proud of your accomplishments. You should always remain humble. Success is hard to come by but easy to go. Stay grounded and hold true to the principles, hard work and characteristics that launched you to success. Once you have achieved a sustained level of success, circle back and launch others on their path to success.

Rule #5: Never sell a product or service without disclosing all known facts —Be honest and upfront with people you do business with. Frustrations breed from unmet expectations. Highlight the pros and cons of the services and products being provided—thus allowing the consumer to make an informed decision with open eyes and pertinent facts.

Rule #6: Credit? Dead it! Use credit wisely? NO!! Dead it! Use credit only when absolutely necessary. If you use credit, pay it off as soon as humanly possible. Nothing separates man/woman from wealth like debt! Wealth is defined as what you own minus what you owe (debt).

Rule #7: Keep family and business separated. Money and blood don’t mix— Doing business with family can create lingering negative ramifications. It’s easy to cut off a business relationship with people you will not see at Thanksgiving Dinner. It’s hard and can be devastating to sever ties with family members because of business dealings.

Rule #8: Never keep large sums of cash on you—Money is the best magician. It can disappear in front of your eyes without you knowing. Carrying large sums of money can subject you to loss, theft, and waste.

Rule #9: Allow money to police you —We get all black and blue (bruised) by money because we make money the master instead of the servant. Money should be used to protect and serve our needs, wants, and desires. It should be used to preserve our best interest. Money used otherwise is brutality.

Rule #10: Never cosign for anyone other than your spouse—When you cosign for a person, you’re saying if they fail to make timely payments at any time, you assume full responsibility for the debt. If the bank, whose lifeline is dependent upon their ability to lend money and earn interest off of loans, is saying this person is a credit risk, and the only way they will lend money is for them to have a cosigner, then the person in question has a high probability of default. Why would you vouch for them and risk your financial wellbeing?

By following these rules, you’ll have serious money and less headaches.

(Damon Carr, Money Coach can be reached @ 412-216-1013 or visit his website @ damonmoneycoach.com)