Officials at Chicago State University and the City Colleges of Chicago said despite new legislation that authorizes their schools to borrow money they have no plans to do so this year. Officials there plan to trim costs and live within respected budgets t

Officials at Chicago State University and the City Colleges of Chicago said despite new legislation that authorizes their schools to borrow money they have no plans to do so this year. Officials there plan to trim costs and live within respected budgets to make up for the shortfall.

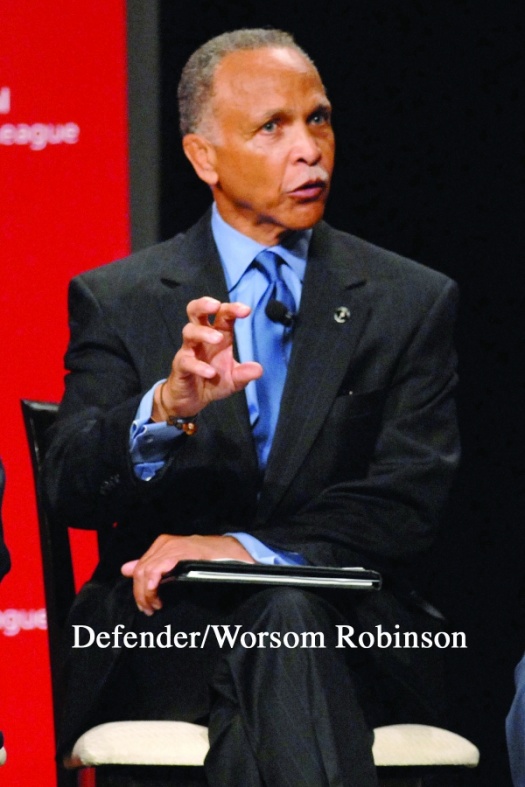

Wayne Watson, president of CSU, said his South Side school is owed $13 million from the state and CSU depends greatly on state dollars.

“We will not need to use that vehicle (borrowing) to address our fiscal challenges because we have taken steps to improve our finances,” Watson told the Defender. “We have frozen vacant positions, reduced travel expenses and spending overall.”

The annual operating budget for CSU is $93 million.

Gov. Pat Quinn signed two separate bills this month that cap interest rates on any loans taken out by community colleges or state universities while the schools wait on state funding.

“This legislation will give our public universities an important fiscal tool to manage through this unprecedented economic crisis,” Quinn said in a written statement. “We are committed to doing everything we can in Illinois to make sure our students receive the highest-quality education possible.”

Ken Gotsch, chief financial officer for the City Colleges of Chicago, said the annual budget for the seven schools CCC runs is $87 million. He explained that CCC is owed $10.6 million from the state. “We will not be borrowing. Only 20 percent of our funding comes from state so there is no need to borrow,” Gotsch said. “The money the state owes us is needed to help pay teacher salaries and provide financial assistance to needy students.”

Both CSU and the city colleges have a predominately Black and student population. Senate Bill 642 allows state universities, like CSU, to borrow money equal to the amount of vouchers that have been submitted to the state but remain unpaid for fiscal year 2010.

State Sen. William Haine (D-Alton) and state Rep. John Bradley (D-Marion) sponsored the legislation.

But to borrow money under the new law, a university’s board of trustees must pass a resolution that outlines the need to borrow, the maximum amount to be borrowed and the maximum amount of interest to be paid.

The legislation also requires that the borrowing take place within 90 days. All borrowing must be repaid within one year or less.

Additionally, all borrowing must be approved by the state comptroller and the schools must produce a detailed account of how the borrowed funds are being used within 15 days of the borrowing. The other legislation Quinn signed was Senate Bill 2615, which was sponsored state Sen. Gary Forby (D-Benton) and state Rep. John Bradley (D-Marion). This bill allows community colleges to issue double the amount of bonds they are permitted to issue under current Illinois law for the next three years.

The legislation also permits community college districts to establish a line of credit, which is subject to amount, repayment and interest restrictions.

Under the new law, a community college’s board of trustees must pass a resolution to allow the borrowing.

Quinn said helping community colleges is a top priority of his administration. “We must give our community colleges all the tools and resources necessary to manage their checkbooks in these tough economic times,” the governor added. “Our students’ education is the state’s foremost priority.

Copyright 2010 Chicago Defender.