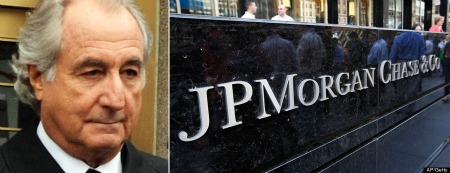

JPMorgan Chase is reportedly about to cut a sweet deal to dodge criminal charges over its role in the Bernie Madoff Ponzi scheme. It’s just the latest evidence that, despite their tough talk, U.S. prosecutors still think some banks are too big to jail.

JPMorgan is close to paying about $2 billion to settle claims that, as Madoff’s main bank for many years, it ignored blatant signs that Madoff was up to no good, the New York Times reports. As part of the deal, JPMorgan will also enter what’s known as a deferred prosecution agreement, where everybody will agree that the biggest U.S. bank broke criminal laws and also that prosecutors don’t plan to do anything about it, as long as JPMorgan keeps its nose clean.

Prosecutors, including U.S. Attorney Preet Bharara, considered and rejected the idea of making the bank actually plead guilty to criminal charges, according to the NYT. That’s disappointing, considering it was Bharara who declared this summer: “I don’t think anyone is too big to indict, no one is too big to jail. There’s enough moral hazard in the industry. If you give people a blank check and tell them they have a get-out-of-jail-free card because of their size…that’s a very dangerous thing.”

To read more, click here.