Gambling Casino Quite a Crap Shoot for Chicago’s Poor

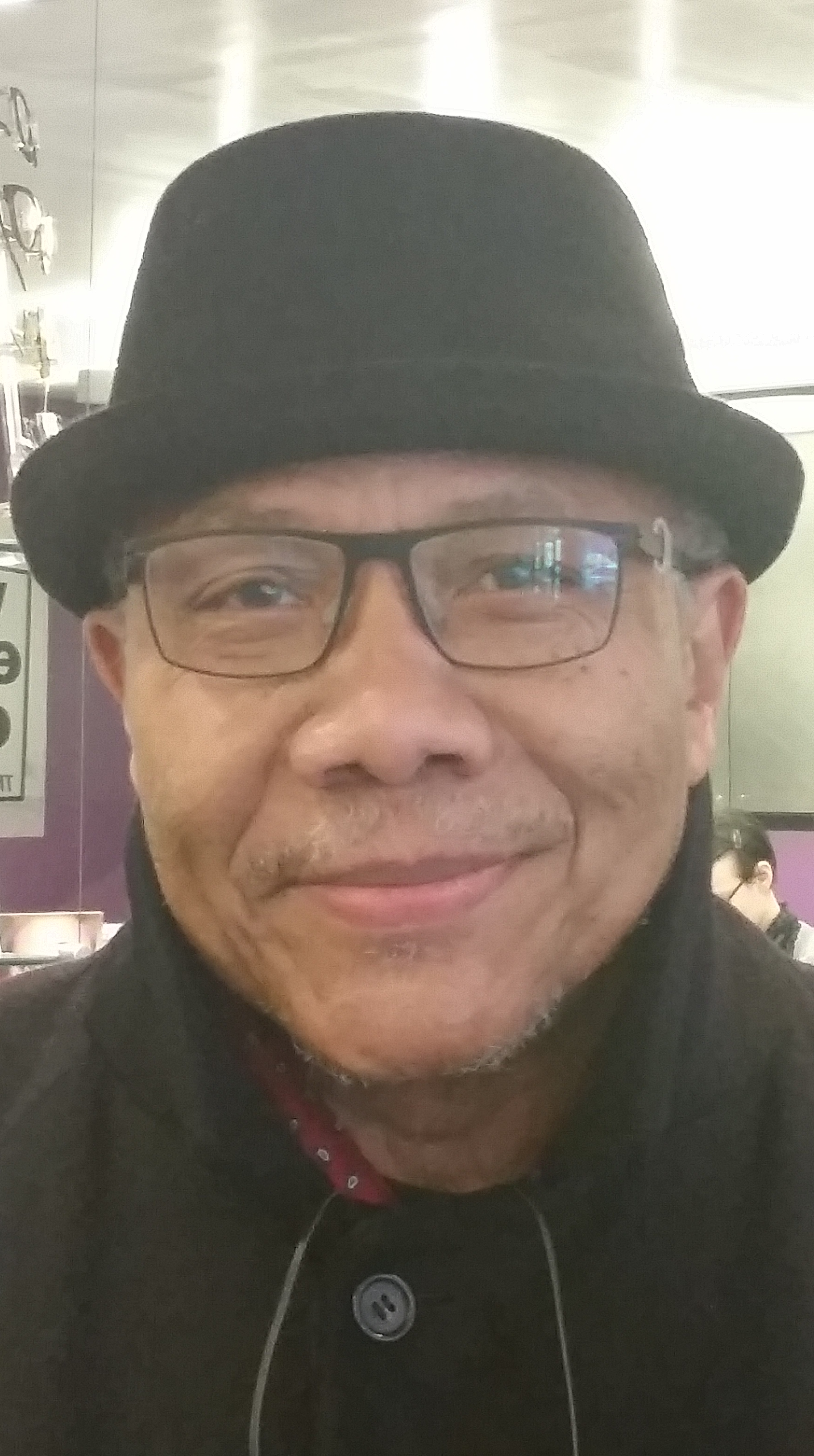

by Monroe Anderson

I’ve got to admit that I wasn’t convinced when Mayor Rahm Emanuel pinky swore that he was going to listen to Chicago’s everyday people, then act on their best interests–his corporate running buddies and the Loop dwellers be damned.

So as I watched Monday’s news clips on the Mayor being sworn in for his second term, I was doggedly determined to stick with my resolve to give the man a second chance. He said that he was going to listen to the people. I’m all eyes.

One of the things I hope the people who claim they care for the people, like those Black men of faith who threw their full support behind Emanuel, tell him to fold ‘em when it comes to his plan to bring a gambling casino to Chicago. I hope they quit winking and nodding long enough to tell Mayor Emanuel the truth: a Chicago casino will do more evil than good to the city’s poor.

If these mayoral supporters have trouble manning up to tell Emanuel like it will be, I suggest they take note of the alarming conclusion business writer, Derek Thompson, came to last week in his report, titled “Lotteries: America’s $70 Billion Shame,” on the Atlantic.com website.

“States are making their most hopeless citizens addicted to gambling to pay for government services,” he concluded, after referring to a Duke University study that found that the poorest third of households buy half of all lotto tickets.

For those of us lucky enough to have money in the bank, it’s recreational gambling and a voluntary payment of just one more hidden tax. But, for the poor, the lottery is virtually the first and last hope of attaining disposable income.

I can remember when Blacks played the policy game for nickels and dimes before the state took it over, renamed it the lottery and jacked up the cost of a bet to a buck. It was okie dokie back then because all the money gambled away was going to pay for state and local schooling.

That promise lasted about as long as topless bars in the 1970s remained tourist attractions. Then the Illinois State Legislature pulled a three-card motley, moving the take from education to general revenue. Over the years, the state legislators, fearful that the voter’s might wise up and throw the bums out, never got around to raising taxes to cover the pension pool for state employees. Now the Baby Boomers among the state workers want to go home to roost. They’re retiring in hoards as soon as they can. The same holds true for Chicago’s Baby Boomers who were police and fire and education employees. Their promissory notes keep on coming, stamped “due.”

The state has an estimated $6 billion deficit and over $110 billion in unfunded pension liabilities. Chicago has a $30 billion pension crisis. It’s easy to see the wall at the end of the road. It has a big flashing neon sign that says “raise property and income taxes right now.”

All that debt with no easy way out leaves Mayor Emanuel and his city waist-deep in junk bond ratings. When he was in full-attack mode during the mayoral campaign, Emanuel pointed to Springfield and hinted at Washington as he pretended that the posse was coming. Although a Republican, Gov. Bruce Rauner is Mayor Emanuel’s pal. The two men have shared vacations and pricey bottles of wine together. It was easy to assume that Rauner would give a fellow one-percenter a hand. If not, Emanuel’s old boss, President Barack Obama, would have his back.

It’s obvious now that the only thing either the governor or the president can do is wish the mayor the best of luck. Emanuel is now feigning that a casino will come to the rescue because unlike Gov. Pat Quinn, who vetoed a measure that would have allowed a Chicago casino, Gov. Rauner has said he’s open.

Mayor Emanuel would have us believe that the outflow of money to suburban casinos could end up in the coffers of a Chicago casino, bringing in more than $450 million a year in revenue.

I’m no mathematician but with the help of my cell phone calculator I know the numbers don’t add up. Let’s see, $30 billion minus $450 million, leaves the city’s pension crisis at a paltry $29 billion, $550 million.

On the upside, those Chicagoans with the least to lose, won’t have to cross state lines or trek out to Joliet or Elgin to pursue their dreams while blowing the rent and grocery money.

Should Chicago open a gambling casino–near McCormick Place, right where the new Marriott Hotel and DePaul University basketball stadium are to be built–luck won’t be a lady that night or any other night to follow. At least not for the vast majority who can’t afford to blow the little money they have on a dream where the house always wins.