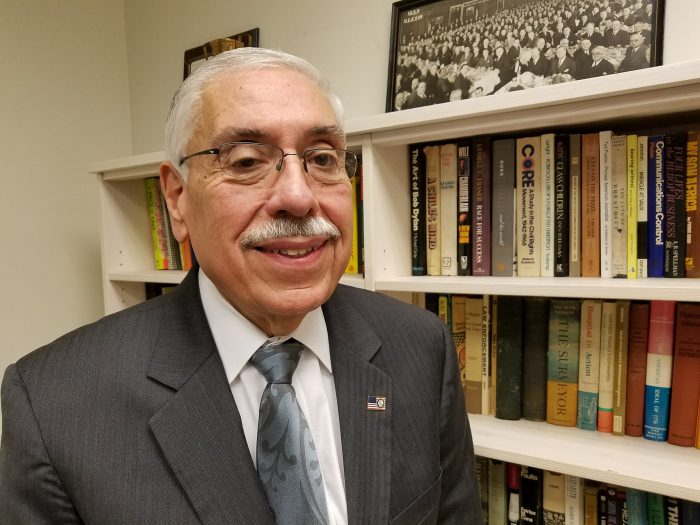

Cook County Assessor Joe Berrios is considered a major political heavy weight in Illinois politics. His reign as one of the most influential Democrats and Latino public officials did not come easy. Born and raised in Chicago, he graduated from Lane Tech High School to attend the University of Illinois, earning his bachelor’s Degree in Accounting.

His first run for public office, he won the State Representative seat in the 9th district, becoming the first Hispanic-American to serve in the Illinois General Assembly. In 1988 he began a long-standing role on the Cook County Board of Review, which lasted for 22 years. Berrios was elected Cook County Assessor in 2010 and is currently serving a second term.

It’s primary election time and Berrios has come under fire by critics for the county’s system of assessing property taxes higher for property owners in low to middle class residential areas compared to downtown corporate building owners. In a Chicago Tribune series that breaks down the inaccuracies of the Cook County assessor’s office, it revealed disturbing evidence under former assessor James Houlian and now Berrios that the system rewards the wealthy while “punishing the poor.”

Berrios who is also the Cook County Democrat party chair is currently running against financial manager and Oak Park resident Fritz Kaegi. Candidate Andrea Raila is currently under review by the Electoral Board. Kaegi has garnered a great deal of support from other Democrats to unseat Berrios. But Berrios is standing his ground on his record and the community outreach he and his office has implemented to assist property owners in preventative measures of losing their homes.

In addition, Kaegi has lashed out at Berrios for his history of nepotism and lack of diversity in the assessor’s office. Berrios says his office has 49.3 percent of minorities including nearly 33 percent African American, 17 percent Latino and 7 percent of other people of color in his department.

“I challenge him, and he should take a look at the numbers at the assessor’s office. Our minorities comprise almost 50% of that office. When I first got in there, the numbers weren’t that high. We have to struggle with the segment of compliance with the federal. They have come in and tried to change all of the qualifications of someone coming into the office. They wanted to make it standard to have a college degree for some of these jobs. I said, some of these jobs you can learn while working here and you need a high school diploma.” He says he fought with them about making sure the scales were balanced and fair.

“A clerk or a counter person needs to have a college degree to help someone to fill out the application? I want to make sure the job description for the office fit the job. I have them doing what I think is necessary to make sure that minorities can come to the office,” he explains.

“We’ve done an incredible job creating jobs for minorities. When I first got there, the majority of people there were White. They were trying to block more minorities there by building the Shackman Decree. I got pulled into it because Assessor Houlihan didn’t follow the rules. The first time I walked through the doors, ‘we’re here to monitor you’,” Berrios said. “What did we do to violate? The prior Assessor never filed the proper paper work up to 5 years.”

However, it’s not about who works in his office that is a major concern among voters, it is the disparities in the county’s property assessment system. Why do skyscraper and commercial property owners pay less in assessed taxes than a senior resident in the Chatham or the Brighton Park community?

He answers, “A home is supposed to be assessed at 10 percent of the fair market value of that property. If you are not assessed at 10 percent, there is a repeal process. We are working with Tyler Tech to come up with a new model, new system to become better. I inherited 40 years of problems, but the Chicago Tribune expects me to do this in less than 7 years. We contracted with Tyler about 3 years ago before all of this Tribune stuff, but no one talked about the other assessors.”

Berrios insists his office must adhere to the laws and the court. No one is more familiar with the Board of Review than Berrios, but if the court rules in the favor of commercial property owners—he says the assessor’s hands are tied. We disagreed with what the court did, but we don’t have a judicial right—it’s their decision.

“We want to educate people on what their rights are. Ten percent is ten percent. That’s what the law is. Don’t ask me to break the law. Same thing about commercial properties. Commercial properties are assessed at 25 percent,” he says. “A fair market value or by state law or the actual value its worth based on income, net value and what’s going on with that property. If you have two similar buildings downtown—one at $150 per sq. ft., the other $160 per sq. ft, you have to justify that or otherwise all of these taxing bodies have to give back money.”

As he seeks a third term, Berrios says these changes he’s inherited take time to change. He says it will take legislation in Springfield and revising a new classification voted by the County board eight years ago.

“Springfield needs to sit down… and if they want to change the law, then I’ll follow the law.”

Follow Mary L. Datcher on Twitter @globalmixx Instagram @mdatcher